Mobile Services

Huawei partners with Ecosystem

NEW DELHI: The concept of digital banking is being implemented globally. Leaders of the global banking industry are thinking about how to implement digital transformation in essence. Today, Huawei held the Global Financial Services Industry (FSI) Summit, with the theme “Leading New ICT, Accelerating New Digital Finance Transformation” at the Shangri-La Hotel in Beijing.

NEW DELHI: The concept of digital banking is being implemented globally. Leaders of the global banking industry are thinking about how to implement digital transformation in essence. Today, Huawei held the Global Financial Services Industry (FSI) Summit, with the theme “Leading New ICT, Accelerating New Digital Finance Transformation” at the Shangri-La Hotel in Beijing.

This summit attracted more than 800 financial customers and industry experts from financial institutions and consultancies worldwide.

These included Industrial and Commercial Bank of China (ICBC), DBS Bank of Singapore, China Life Insurance Group, China Minsheng Bank (CMBC), the Agricultural Bank of China (ABC), China Merchants Bank (CMB), and China Pacific Insurance Group (CPIC).

Financial institutions will become a platform that connects everything and drives financial innovation

The Leading with Digital in Banking white paper recently released by the International Data Corporation (IDC), a global consulting firm, identified that digital banks around the world are shifting from digital services to digital transformation. The next wave of banking transformation will start with fully-connected banks. Banks are becoming more open regarding technologies and business models. The bilateral relationship between traditional banks and FinTech companies will evolve into an organic ecosystem. Transformed and strengthened core systems will lay the foundation for new growth in the banking industry.

Ma Yue, Vice President of Huawei Enterprise BG, President of EBG Global Sales said that: “With the digital transformation trend in the financial industry, financial institutions across the globe need to continuously deepen their digital strategies and transformation initiatives to achieve platform-based strategic transformation. Banks are the platform that connects everything and provides digital financial services in a fully-connected era. Huawei follows the “platform + ecosystem” strategy, helps global financial customers develop scenario-based products and services and implement intelligent customer management.”

The foundation for implementing the financial platform strategy is that the ICT infrastructure is platform-based and has a prosperous financial ecosystem. Kong Bing, Deputy General Manager, HQ Information Technology Department, ICBC, said that, under the background of the rapid development of information Bank, ICBC has started the Smart Banking Information System project, which will be around the whole line of business transformation work requirements, further strengthen the deep integration of finance and technology, and continuously strengthen the foundation for the innovation of science and technology, for the better Smart Banking transformation.

With the development of technologies such as cloud computing, 5G, Big Data, AI, and blockchain, facial recognition applications for payment authentication, unattended bank branches, and cross-border settlement are becoming a reality. In the future, financial institutions will become a comprehensive platform for financial information bearing and transactions, and connect all people and things. Huawei focuses on integrating financial values, ensuring better connections, and cooperating with industry partners to accelerate digital transformation.

Looking to the future of the banking industry, Brett King, the author of Bank 3.0 pointed out that “5G will push the bank to be real-time. By 2025, more people will transact and interact with their money on a computer, smartphone, voice and augmented reality every day, than those that visit the world’s collective network of branches on an annual basis.”

During the afternoon, bank customers and system integrators from home and abroad gave excellent speeches and interactive discussions at the two tracks, Finance–New Platform and Finance–Full Connection. The afternoon also saw the establishment of Huawei-CMBC joint innovation lab. In addition, Huawei FusionInsight LibrA, a new-generation converged data warehouse, made its debut in China. This data warehouse aims to provide a unified, scalable, and high-performance data analysis platform to enhance the real-time data processing capability of financial institutions.

At the summit, Huawei demonstrated 16 major financial solutions, in a scenario-based manner, in a 6002 exhibition area that contained four sub-exhibition areas: Finance Cloud, Financial Big Data, High-Performance Open Platform, and Smart Branch.

Financial Cloud Exhibition Area: Financial cloudification has become an industry trend. Abundant cloud infrastructure solutions, such as the intelligent financial O&M platform, financial private cloud, SDN network, and cloud disaster recovery solution, are starting to be noticed. This exhibition area also revealed the bancassurance business SaaS cloud solution, developed by Huawei and Sinosoft based on Huawei’s public cloud. This solution can help small-and medium-sized commercial banks quickly implement bancassurance businesses.

Financial Big Data Exhibition Area: The next-generation converged data warehouse solution, based on the x86 platform and distributed technology, has industry-leading performance and supports online fast capacity expansion. This solution has been applied to numerous large commercial banks such as ICBC.

High-Performance Open Platform Exhibition Area: FusionCube, based on x86 hyper-converged architecture, supports fast construction of unified management and standardized resource pools, helping banks quickly integrate branches’ resources. The memory computing platform of GridGain Systems, based on Huawei’s hyper-converged architecture, helps banks improve customers’ real-time experience and has been used by Sberbank, the largest commercial bank in Russia.

Smart Branch Exhibition Area: Multiple solutions, such as mobile office desktop cloud and All-in-one equipment room for bank branches, are displayed in real service mode. The Mobile Money solution has served over 150 million people in 19 underdeveloped regions, with more than 35 million transactions per day.

The financial industry is a high-value industry that Huawei has invested in for many years. Huawei’s digital banking solution has been put into commercial use in more than 300 financial institutions, including 6 of the world’s top 10 banks. In Europe, the Asia Pacific, Russia, and other regions, Huawei has entered the local mainstream systems of financial customers. This has helped many Fortune Global 500 financial institutions, such as BPCE. In the Chinese market, Huawei has become a mainstream IT equipment supplier of the four major state-owned banks, as well as China Development Bank, and Bank of Communications.

5g

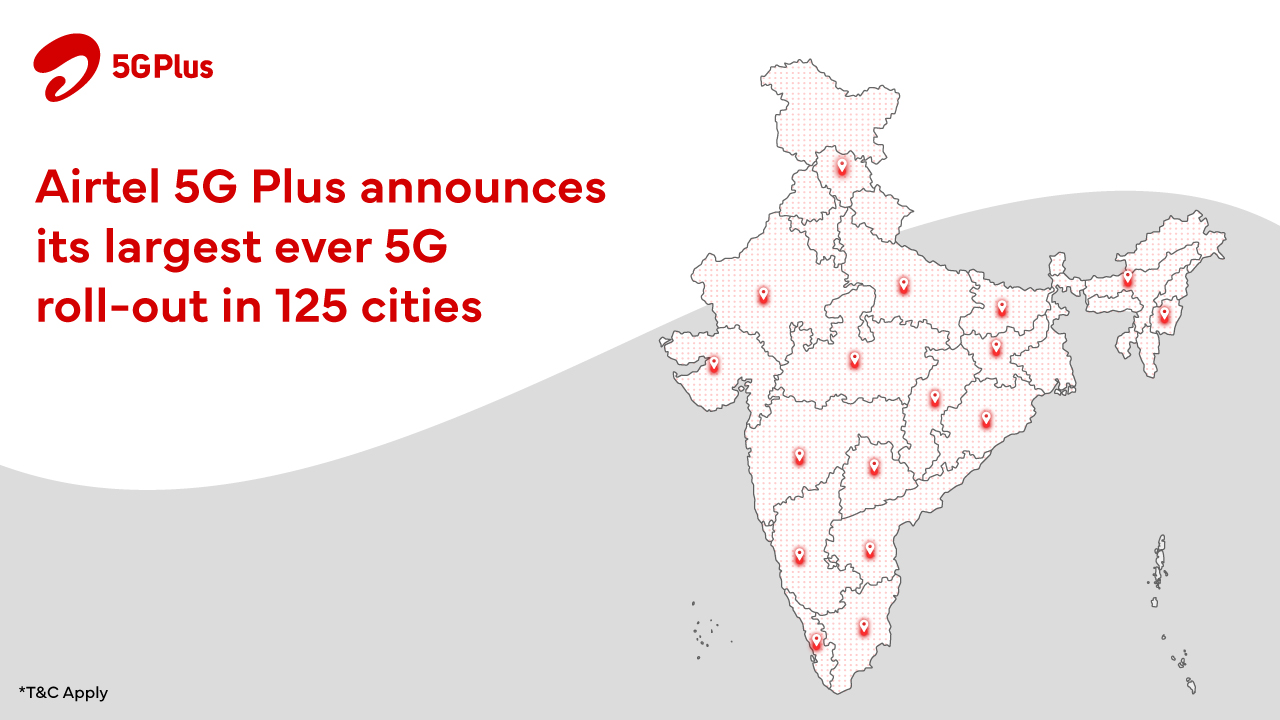

Airtel announces its largest ever 5G roll-out in 125 cities

NEW DELHI: Bharti Airtel, India’s telecommunications services provider, today announced the launch of its ultra-fast 5G services in 125 cities. Airtel 5G Plus service is now available to customers in over 265 cities in the country.

Airtel 5G Plus has three compelling advantages for customers. First, it runs on a technology that has the widest acceptance in the world with the most developed ecosystem. This ensures that all 5G smartphones in India seamlessly work on the Airtel network. Second, the company promises to deliver the best experience – between 20 to 30 times higher speeds than today coupled with brilliant voice experience and super-fast call connect. Finally, Airtel 5G Plus network will also be kinder to the environment with its special power reduction solution. Powered by the reliable Airtel network infrastructure, Airtel 5G Plus will provide superfast access to High-Definition video streaming, gaming, multiple chatting, instant uploading of photos et all.

Commenting on the launch, Randeep Sekhon, CTO, Bharti Airtel said, “5G has revolutionized the world of internet, ushering new era of connectivity and communications that will prove to be a game-changer for the country. At Airtel, we remain committed to delivering the highest quality of network and service to our customers as we roll-out 125 more cities today. Airtel was the first in the country to offer 5G services in October 2022, and today’s mega launch is our promise to connect every Airtel customer in the country with ultra-fast Airtel 5G Plus. Our 5G rollout is on track to cover all towns and key rural areas by March 2024.”

Airtel 5G Plus service availability will continue to rapidly expand – including service in all towns and villages in the country soon – as the company is working towards offering nationwide coverage. Airtel is now offering its 5G services in every major city from the upper northern city of Jammu to the southern tip of Kanyakumari.

In the last one year, Airtel has demonstrated the power of 5G with a host of powerful use cases that will change the way customers lead their lives and do business. From India’s first live 5G network in Hyderabad to India’s first private 5G network at the BOSCH facility in Bengaluru to partnering with Mahindra & Mahindra to make its Chakan manufacturing facility, India’s first 5G enabled auto manufacturing unit, Airtel has been at the forefront of 5G innovation.

5g

Apple rolls out beta programme for iPhones to enable 5G services

NEW DELHI: Apple Inc has rolled out a beta programme to enable 5G on Apple devices as the upgrade lets users try out pre-release software.

This software upgrade enables 5G access on Apple devices, as and when service providers Jio, Airtel and Vodafone enable 5G network access, sources said.

Apple Users have to enrol for the Beta Programme on the website, install a profile and download the software.

Jio users using iPhone 12 and above, in cities where JioTrue5G has been rolled out, will be invited to the Jio Welcome Offer. Jio Welcome Offer provides unlimited 5G data at up to 1 Gbps speed to users at no additional cost. However, there is a condition that prepaid users must be on active Rs 239 and above plan. All Postpaid users are eligible for this trial.

Airtel is not providing any special 5G offer like Jio to their users. In the cities/areas in which the Airtel 5G network has been launched, users can trial 5G services as a part of their existing plan, once they have updated the latest Apple Beta software.

While an email sent to Apple did not solicit an immediate response, the firm had last month stated: “We are working with our carrier partners in India to bring the best 5G experience to iPhone users as soon as network validation and testing for quality and performance is completed. 5G will be enabled via a software update and will start rolling out to iPhone users in December”.

Airtel and Jio customers on iPhone 14, iPhone 13, iPhone 12 and iPhone SE (3rd generation) models can experience 5G as part of Apple’s iOS 16 Beta Software Program. The Apple Beta Software Program is open to anyone with a valid Apple ID who accepts the Apple Beta Software Program Agreement during the sign-up process.

If a user has an iCloud account, that is an Apple ID, it is recommended they use that. If they do not have an iCloud account or any other Apple ID, they can create one.

Customers who want to try the beta software should back up their iPhones before installing the beta software. It is recommended to install the beta software only on non-production devices that are not business-critical. Users can also provide feedback to Apple on quality and usability, which helps Apple identify issues, fix them, and make Apple software even better.

The iOS beta comes with the built-in Feedback Assistant app, which can be opened from the Home screen on the iPhone or iPad or from the Dock on the Mac.

Source: Press Trust of India

5g

Nokia wins multi-year deal with Reliance Jio India to build one of the largest 5G networks in the world

NEW DELHI: Nokia has announced that it has been selected as a major supplier by Reliance Jio to supply 5G Radio Access Network (RAN) equipment from its comprehensive AirScale portfolio countrywide in a multi-year deal. Reliance Jio is India’s number one mobile operator and has one of the largest RAN footprints in the world.

Under the contract, Nokia will supply equipment from its AirScale portfolio, including base stations, high-capacity 5G Massive MIMO antennas, and Remote Radio Heads (RRH) to support different spectrum bands, and self-organizing network software. Reliance Jio plans to deploy a 5G standalone network which will interwork with its 4G network. The network will enable Reliance Jio to deliver advanced 5G services such as massive machine-to-machine communications, network slicing, and ultra-low-latency.

Akash Ambani, Chairman Reliance Jio, commented: “We are pleased to be working with Nokia for our 5G SA deployment in India. Jio is committed to continuously investing in the latest network technologies to enhance the experience of all of its customers. We are confident that our partnership with Nokia will deliver one of the most advanced 5G networks globally.”

Pekka Lundmark, President and CEO at Nokia stated: “This is a significant win for Nokia in an important market and a new customer with one of the largest RAN footprints in the world. This ambitious project will introduce millions of people across India to premium 5G services, enabled by our industry-leading AirScale portfolio. We are proud that Reliance Jio has placed its trust in our technology and we look forward to a long and productive partnership with them.”

Nokia has a long-standing presence in India. This new deal will mean that Nokia is now supplying India’s three largest mobile operators.